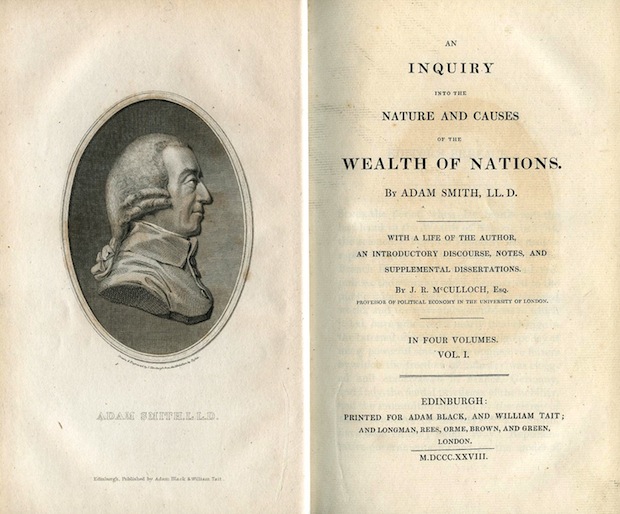

I recently finished reading the landmark classic The Wealth of Nations by Adam Smith. This book has been on my reading list for a long time, but I was discouraged by its length (1200+ pages). Having now read it, I am very glad I did. The breadth and depth of this book is – even after 239 years of publication – a monumental achievement.

Below are key excerpts from the book that I found particularly insightful:

As it is by treaty, by barter, and by purchase, that we obtain from one another the greater part of those mutual good offices which we stand in need of, so it is this same trucking disposition which originally gives occasion to the division of labour.

The value of any commodity, therefore, to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities.

The five following are the principal circumstances which, so far as I have been able to observe, make up for a small ~ pecuniary gain in some employments, and counter-balance a great one in others: first. the agreeableness or disagreeableness of the — employments themselves; secondly, the easiness and cheapness, or the difficulty and expence of learning them; thirdly, the constancy or inconstancy of employment in them; fourthly, the small or great trust which must be reposed in those who exercise them; and fifthly, the probability or improbability of success in them.

I shall conclude this very long chapter with observing that every improvement in the circumstances of the society tends either directly or indirectly to raise the real rent of land, to increase the real wealth of the landlord, his power of purchasing the labour, or the produce of the labour of other people.

Political economy considered as a branch of the science of a statesman or legislator, proposes two distinct objects: first, to provide a plentiful revenue or subsistence for the people, or more properly to enable them to provide such a revenue or subsistence for themselves; and secondly, to supply the state or commonwealth with a revenue sufficient for the public services. It proposes to enrich both the people and the sovereign.

The importation of gold and silver is not the principal. much less the sole benefit which a nation derives from its foreign trade. Between whatever places foreign trade is carried on, they all of them derive two distinct benefits from it. It carries out that surplus part of the produce of their land and labour for which there is no demand among them, and brings back in return for it something else for which there is a demand. It gives a value to their superfluities, by exchanging them for something else, which may satisfy a part of their wants, and increase their enjoyments. By means of it, the narrowness of the home market does not hinder the division of labour in any particular branch of art or manufacture from being carried to the highest perfection.

We must carefully distinguish between the effects of the colony trade and those of the monopoly of that trade. The former are always and necessarily beneficial; the latter always and necessarily hurtful. But the former are so beneficial, that the colony trade, though subject to a monopoly, and notwithstanding the hurtful effects of that monopoly, is still upon the whole beneficial, and greatly beneficial; though a good deal less so than it otherwise would be.

The discovery of America, and that of a passage to the East Indies by the Cape of Good Hope, are the two greatest and most important events recorded in the history of mankind. Their consequences have already been very great: but, in the short period of between two and three centuries which has elapsed since these discoveries were made, it is impossible that the whole extent of their consequences can have been seen.

When a landed nation, on the contrary, oppresses either by high duties or by prohibitions the trade of foreign nations, it necessarily hurts its own interest in two different ways. First, by raising the price of all foreign goods and of all sorts of manufactures, it necessarily sinks the real value of the surplus produce of its own land, with which, or, what comes to the same thing. with the price of which, it purchases those foreign goods and manufactures. Secondly, by giving a sort of monopoly of the home market to its own merchants, artificers and manufacturers, it raises the rate of mercantile !e and manufacturing profit in proportion to that of agricultural profit, and consequently either draws from agriculture a part of the capital which had before been employed in it, or hinders from going to it a part of what would otherwise have gone to it. This policy, therefore, discourages agriculture in two different ways; first, by sinking the real value of its produce, and thereby lowering the rate of its profit; and, secondly, by raising the rate of profit in all other employments. Agriculture is rendered less advantageous, and trade and manufactures more advantageous than they otherwise would be; and every man is tempted by his own interest to turn, as much as he can, both his capital and his industry from the former to the latter employments.

According to the system of natural liberty, the sovereign has only three duties to attend to; three duties of great importance, indeed, but plain and intelligible to common understandings: first, the duty of protecting the society from the violence and invasion of other independent societies; secondly, the duty of protecting, as far as possible, every member of the society from the injustice or oppression of every other member of it, or the duty of establishing an exact administration of justice; and, thirdly, the duty of erecting and maintaining certain public works and certain public institutions, which it can never be for the interest of any individual, or small number of individuals, to erect and maintain; because the profit could never repay the expence to any individual or small number of individuals, though it may frequently do much more than repay it to a great society.

Commerce and manufactures, in short, can seldom flourish in any state in which there is not a certain degree of confidence in the justice of government. The same confidence which disposes great merchants and manufacturers, upon ordinary occasions, to trust their property to the protection of a particular government; disposes them, upon extraordinary occasions, to trust that government with the use of their property. By lending money to government, they do not even for a moment diminish their ability to carry on their trade and manufactures. On the contrary, they commonly augment it. The necessities of the state render government upon most occasions willing to borrow upon terms extremely advantageous to the lender. The security which it grants to the original creditor, is made transferable to any other creditor, and, from the universal confidence in the justice of the state, generally sells in the market for more than was originally paid for it.

But if the empire can no longer support the expence of keeping up this equipage, it ought certainly to lay it down; and if it cannot raise its revenue in proportion to its expence, it ought, at least, to accommodate its expence to its revenue. If the colonies, notwithstanding their refusal to submit to British taxes, are still to be considered as provinces of the British empire, their defence in some future war may cost Great Britain as great an expence as it ever has done in any former war. The rulers of Great Britain have, for more than a century past, amused the people with the imagination that they possessed a great empire on the west side of the Atlantic. This empire, however, has hitherto existed in imagination only. It has hitherto been, not an empire, but the project of an empire; not a gold mine, but the project of a gold mine; a project which has cost, which continues to cost, and which, if pursued in the “”same way as it has been hitherto, is likely to cost, immense expence, without being likely to bring any profit; for the effects of the monopoly of the colony trade, it has been shewn, are, to the great body of the people, mere loss instead of profit. It is surely now time that our rulers should either realize this golden dream, in which they have been indulging themselves, perhaps, as well as the people; or, that they should awake from it themselves, and endeavour to awaken the people. If the project cannot be completed, it ought to be given up. If any of the provinces of the British empire cannot be made to contribute towards the support of the whole empire, it is surely time that Great Britain should free herself from the expence of defending those provinces in time of war. and of supporting any part of their civil or military establishments in time of peace, and endeavour to accommodate her future views and designs to the real mediocrity of her circumstances.

A must read for anyone seeking a deeper understanding of economics.